Understanding your income tax: the effect of having a child on your tax return

Do you have one or more children? If so this will influence the taxes you need to pay or receive. NB Of course this also counts for your foster or adopted children.

Taxes to be paid

Mi taxes es tu taxes. Up until your kid is 18 you pay the taxes over their savings. This means that your kids’ bank accounts will be taken into account as your assets in your income tax return. There are some exceptions to this rule. For instance, in the case of so called “groene beleggingen". If your kid has this they need to file their own income tax return to be able to claim the exemption on these, even if they are underage.

Benefits

Child budget

Sometimes it is possible to get the “kindgebonden budget” (child budget). The Tax Authorities will usually send you a message about this.

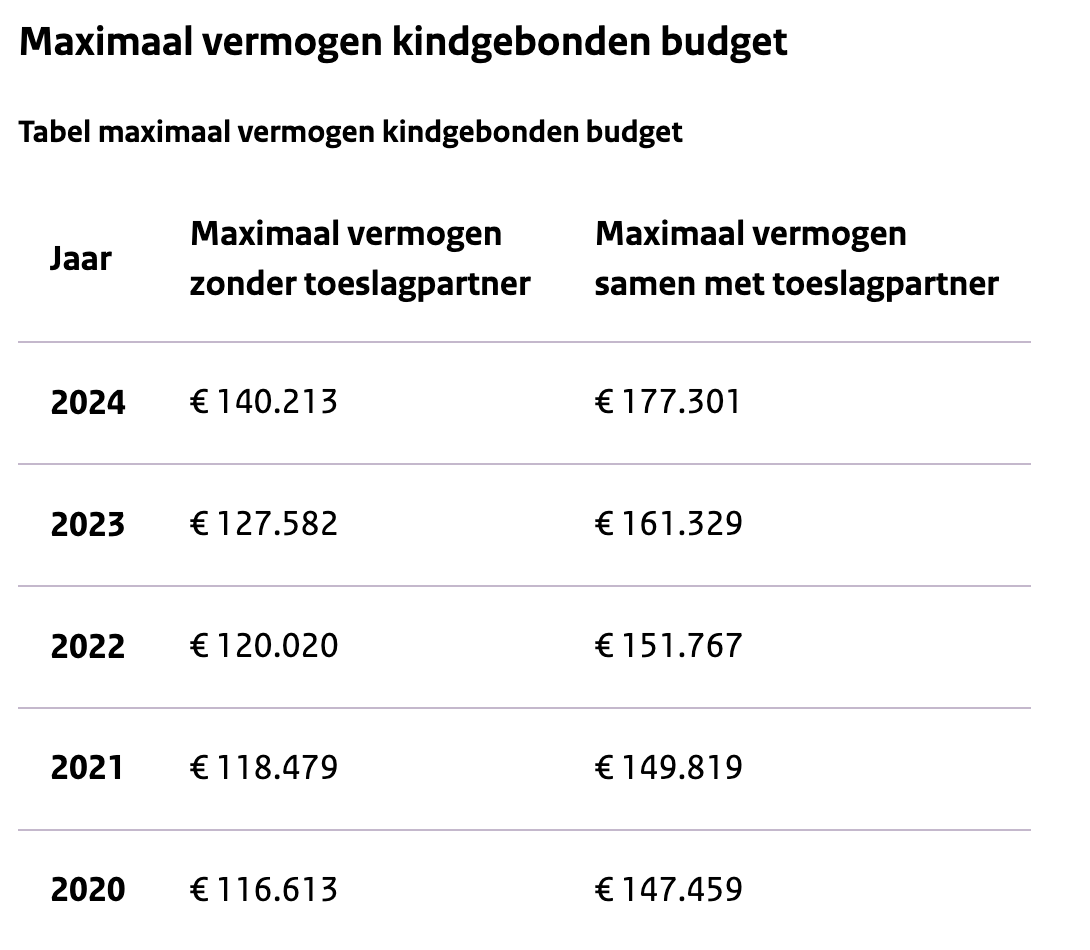

The child budget is an extra benefit from the government that you get when you have a child and a low income. What exactly counts as a low income depends on a couple of things. Your assets play an important role here.

Assets = things you own - your debt. What counts towards your assets is the same as in your tax return.

YES: Savings, shares and for instance a holiday home in the Netherlands or abroad.

NO: The house you live in and your car.

This is all quite comparable with other benefits you might receive. You request them in the same manner

Daycare benefit

Does your kid go to day care? Then you might be eligible for the day care benefit. If you're an entrepreneur, it's a little trickier to report your income than if you're an employee. But we'll help you.

What counts as my income? For the benefits we look at your so called “toetsingsinkomen” (qualifying income). This qualifying income is not your profit (revenue - expenses) but your combined income for tax purposes. In short: your gross profit - the self-employment deduction, start-up deduction and SME exemption. Do you have a tax partner? Then it is the combined income of you and your partner.

Heffingskortingen

In a lot of cases you can receive a tax credit, namely the income-related combination tax credit.

What information is NOT important?

The financial overview of your daycare is not important for us for the income tax return.